DePaul supports its retirees through a variety of benefits, including the Retiree Medical Program. Find

the latest news and updates on retiree benefits on this page. You can also find information about how to prepare for and transition into retirement from DePaul.

News for Retiree Medical Program Members

The 2026 Open Enrollment period is now CLOSED.

You should have received your Open Enrollment package in the mail. The annual Open Enrollment period is a once-a-year opportunity for retirees to evaluate their needs and enroll for benefits. Changes made during Open Enrollment take effect on Jan. 1.

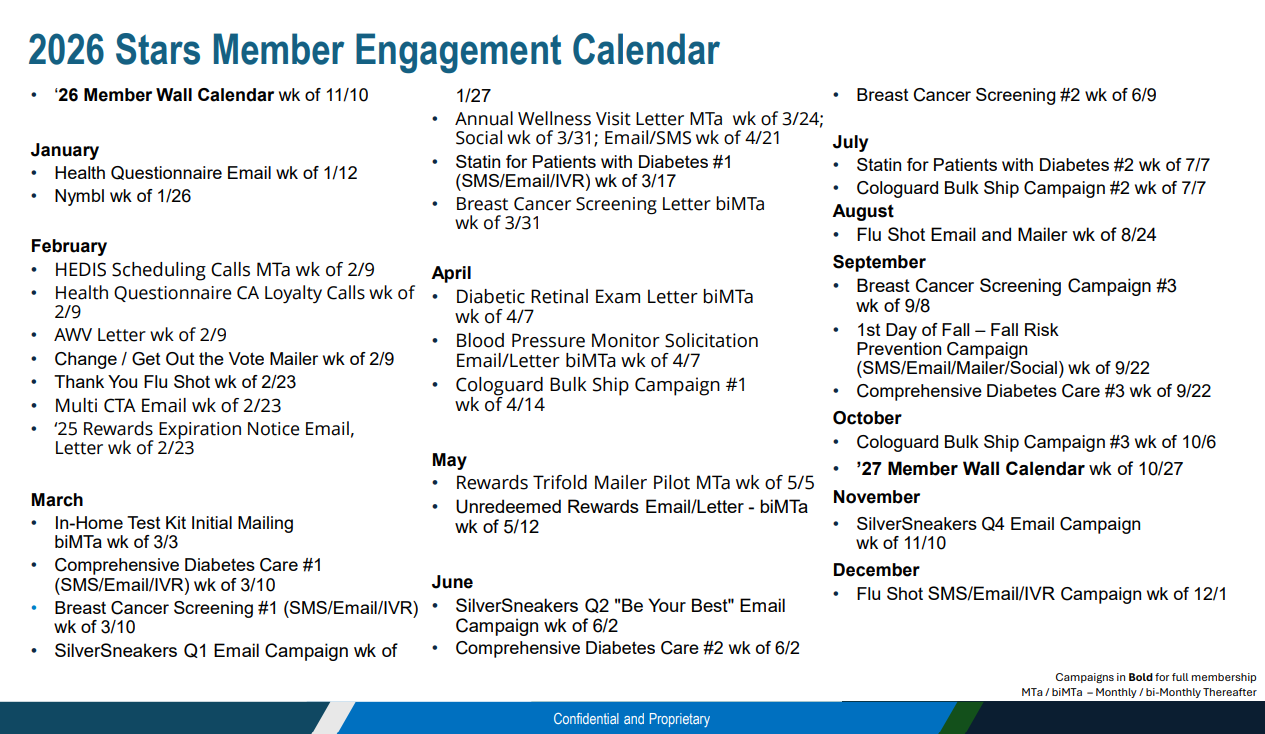

Medicare Advantage Prescription Drug (MAPD) Vendor Communications

MAPD has implemented a member communication calendar for 2026 as part of their STARS program focusing on member engagement and outreach plans. Below is a calendar of scheduled communications and the vendors working with BCBS for your information.

- Carenet: Manages HEDIS member outreach campaigns for all new and existing members.

- Convey: Used for the over-the-counter benefit; encourages members to request a blood pressure monitor to address their BP health measure.

- Everlywell: Used for the in-home test kit program (IHTK).

- Exact Science: Used for Cologuard testing.

- Healthmine: Rewards program that rewards members for completing healthy actions throughout the year.

- SilverSneakers: Fitness/health and wellness program.

Premium Payment Information

Premium Payments for Retiree PPO and HMO Plans

HealthEquity/WageWorks is the direct bill administrator for DePaul's Retiree PPO and Retiree HMO plans. Monthly payments can be made to HealthEquity/WageWorks by:

-

Mail: HealthEquity, P.O. Box 660212 Dallas, TX 75266-0212

-

Phone: Use the HealthEquity interactive phone system at 1-877-722-2667

-

Online: Through your online account at mybenefits.wageworks.com

If you have questions or need assistance, contact HealthEquity at 1-877-722-2667 from 7 a.m. to 7 p.m. (CT), Monday through Friday (excluding company holidays). You may also request help by logging in to your online account at

mybenefits.wageworks.com and clicking the Message Center tab.

Premium Payments for Medicare Advantage Plan

Retirees in the Medicare Advantage Plan make monthly premium payments directly to Blue Cross Blue Shield (BCBS). Medicare Advantage Plan bills are sent out each month on the 15th.

Learn more about medical benefits as a retiree, including latest updates and information.

Figure out when you will qualify for retirement and find answers to common questions.

Find out which benefit options continue as a retiree and how to stay connected to DePaul.

Stay Connected through the DePaul Emeritus Society

DePaul University values the important and continuing contributions of its retired faculty and staff. The DePaul Emeritus Society (DES) strengthens ties between the university and its retirees, and fosters their continued participation in the DePaul University community. Find more information at the

DePaul Emeritus Society website.

For questions about retiree health benefits, to update your contact information, or to inquire about any other Human Resources issues, please contact the Benefits team at (312) 362-8232 or

hrbenefits@depaul.edu.