Log in to www.NetBenefits.com/DePaul and follow the steps below (or call Fidelity at 800-343-0860):

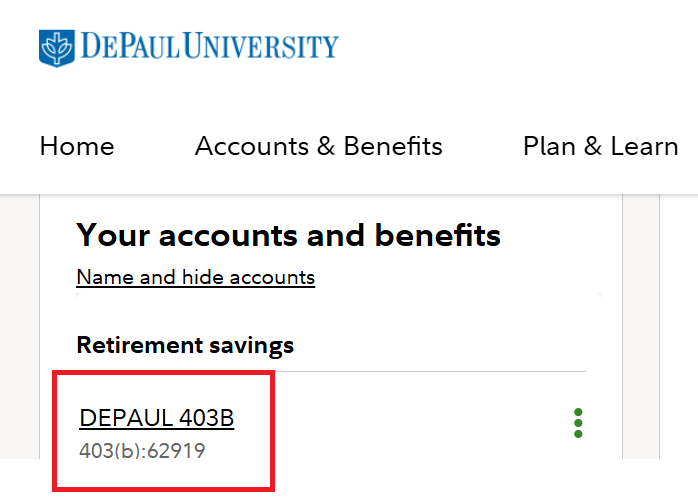

1. From the homepage, select "DEPAUL 403B."

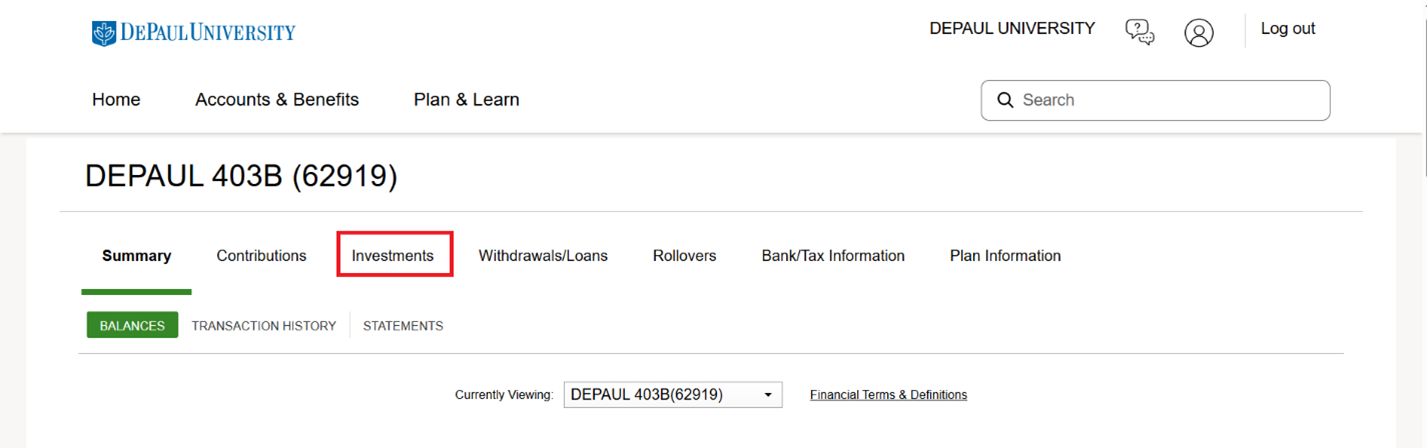

2. Select "Investments."

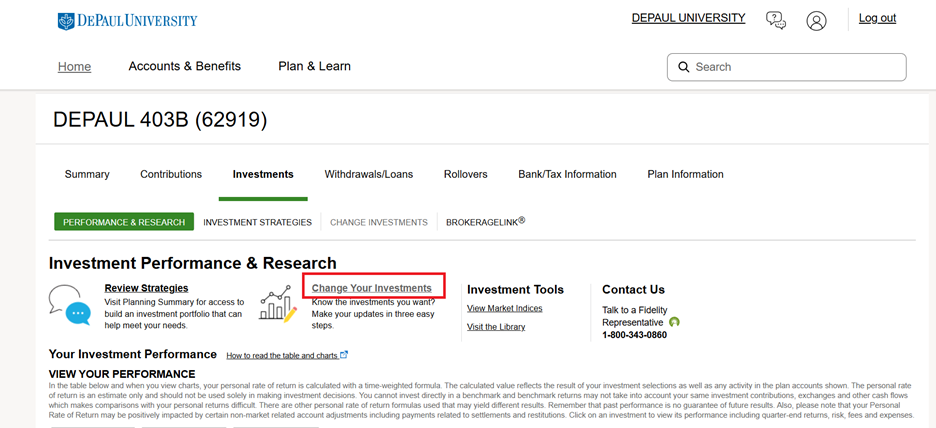

3. Select "Change Your Investments" under the Investment Performance & Research section.

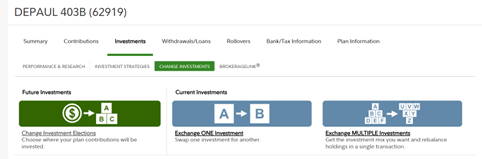

4. Select one of three options: "Change Investment Elections," "Exchange ONE Investment," or "Exchange MULTIPLE Investments."

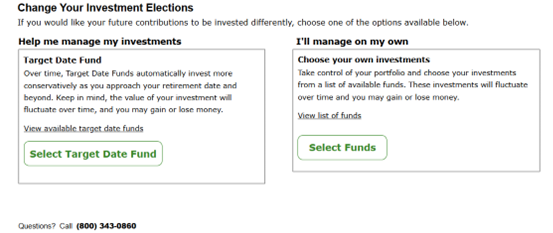

5. Scroll to the bottom of the page and click either "Select Target Date Fund" or "Select Funds."

6. Make your investment elections. Once done, scroll to the bottom of the page and click "Next."

7. Review your elections, then scroll to the bottom of the page and click "Submit."